Interest rate hikes have become a recurring theme in financial news, capturing the attention of investors, consumers, and policymakers alike. These increases, often implemented by central banks to combat inflation or stimulate economic growth, have wide-ranging implications for the economy, affecting everything from mortgage rates to stock prices. As we navigate through 2025, understanding the factors driving these interest rate hikes and their impacts on various sectors of the economy is critical.

Understanding Interest Rates

The Role of Interest Rates in the Economy

Interest rates are a vital component of economic theory and practice. They represent the cost of borrowing money and the return on savings. Central banks, such as the Federal Reserve in the United States, adjust these rates to influence economic activity.

Cost of Borrowing: Higher interest rates increase the cost of loans, making it more expensive for consumers and businesses to borrow funds. This can lead to reduced consumer spending and business investment.

Savings Incentives: Conversely, higher interest rates incentivize saving, as individuals can earn more on their deposits. This can lead to a decrease in immediate consumption but may encourage long-term financial stability.

Economic Growth: Central banks use interest rates as a tool to manage economic growth. Lowering rates can stimulate spending and investment during economic downturns, while raising rates can help cool an overheating economy and combat inflation.

The Mechanism of Interest Rate Hikes

When central banks decide to increase interest rates, they typically do so in response to specific economic indicators:

Inflation: A primary driver for interest rate hikes is rising inflation. When prices for goods and services increase at a fast pace, central banks may raise rates to curb spending and bring inflation under control.

Economic Growth: Strong economic growth can also prompt rate hikes. As the economy expands, the demand for credit increases, leading to higher borrowing costs. Central banks might preemptively raise rates to prevent the economy from overheating.

Labor Market Conditions: A tight labor market, characterized by low unemployment, can lead to wage growth and increased consumer spending, further driving inflation. Central banks monitor these conditions closely when considering rate adjustments.

Current Economic Landscape

Post-Pandemic Recovery

The global economy has seen significant shifts following the COVID-19 pandemic. In many regions, economic recovery has been rapid, leading to rising consumer demand and increased inflationary pressures. This recovery has led to discussions about interest rate hikes as a necessary measure to maintain economic stability.

Supply Chain Disruptions: Ongoing supply chain issues have resulted in shortages and increased costs for goods, contributing to higher inflation. Central banks are responding to these pressures by considering interest rate increases.

Consumer Spending Patterns: As vaccination rates rise and restrictions ease, consumer spending has surged. This increased demand, combined with supply constraints, has further fueled inflation, prompting central banks to act.

Global Economic Trends

Interest rate hikes are not confined to any single country; they are a global phenomenon reflecting various economic conditions:

United States: The Federal Reserve has signaled a series of rate hikes in response to rising inflation and strong economic growth. The Fed aims to strike a balance between supporting the recovery and managing inflation risks.

Europe and the UK: European Central Bank and Bank of England have also indicated potential rate increases as they monitor inflation and growth. The dynamics in these regions are influenced by their unique economic conditions and recovery trajectories.

Emerging Markets: Many emerging market economies are facing heightened inflationary pressures due to rising commodity prices. Central banks in these regions may need to raise rates more aggressively to combat inflation.

Implications of Interest Rate Hikes

1. Impact on Borrowing Costs

One of the most immediate effects of interest rate hikes is an increase in borrowing costs:

Mortgages: Higher interest rates lead to increased mortgage rates, making homebuying more expensive. Potential homeowners may be priced out of the market, leading to a slowdown in housing demand.

Consumer Loans: Rates on auto loans, personal loans, and credit cards may rise, resulting in higher monthly payments. Consumers may be less likely to take on new debt, impacting overall spending.

Business Financing: Companies often rely on loans for expansion and operations. Increased borrowing costs can lead to reduced business investment, impacting economic growth and job creation.

2. Effects on Financial Markets

Interest rate hikes can also lead to significant fluctuations in financial markets:

Stock Market Reactions: Generally, higher interest rates can negatively impact stock prices. As borrowing costs rise, corporate profits may shrink, leading to decreased investor confidence. Growth-oriented technology stocks are often particularly sensitive to interest rate increases.

Bond Markets: As interest rates rise, the prices of existing bonds tend to fall. Investors may shift their portfolios in response to changing rates, impacting bond market dynamics.

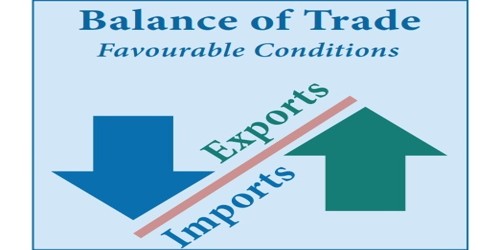

Currency Strength: Higher interest rates can attract foreign investment, leading to currency appreciation. A stronger currency can affect exports and imports, as it makes exports more expensive and imports cheaper.

3. Consumer Behavior and Spending

Consumer behavior tends to shift in response to interest rate hikes:

Decreased Spending: Higher borrowing costs typically lead to reduced consumer spending. Individuals may prioritize paying down existing debts rather than taking on new loans.

Savings Incentives: Consumers may respond to higher interest rates by increasing their savings, particularly if deposit rates rise. This behavior can help improve household financial stability but may also lead to a decline in consumer demand.

4. Economic Growth Prospects

The timing and magnitude of interest rate hikes can have long-term implications for economic growth:

Stabilization: If managed properly, interest rate hikes can help stabilize the economy by controlling inflation and preventing asset bubbles. Central banks aim to maintain a delicate balance between growth and inflation.

Risk of Recession: Rapid or overly aggressive rate hikes can potentially lead to a slowdown in economic activity and even recession. Central banks need to carefully gauge the effects of their actions on consumer confidence and business investment.

Analyzing Market Reactions

Historical Context of Interest Rate Changes

To understand the current reactions to interest rate hikes, it is helpful to analyze past instances:

2008 Financial Crisis: In the wake of the financial crisis, central banks around the world slashed interest rates to near-zero levels to stimulate economic recovery. As the economy improved, attention turned to normalizing interest rates, leading to gradual hikes in subsequent years.

Post-COVID Recovery: The pandemic prompted unprecedented monetary stimulus, leading to concerns about inflation as economies reopened. As growth resumed, central banks have navigated the dual challenges of managing inflation while supporting recovery, leading to the current wave of rate hikes.

Investor Sentiment

Investor sentiment plays a crucial role in market reactions to interest rate hikes. Markets can turn volatile as investors attempt to gauge central bank intentions and the potential implications for their portfolios:

Volatility: Rate hikes often lead to market volatility as investors adjust their expectations. Uncertainty surrounding future economic conditions can amplify these reactions.

Sector Rotations: Investors may shift their allocations in response to rate hikes, favoring sectors that typically perform well in a rising rate environment, such as financials, while reducing exposure to growth-oriented sectors.

The Outlook for Interest Rates

Short-Term Projections

In the short term, interest rate hikes are expected to continue as central banks respond to rising inflation and economic growth:

Central Bank Guidance: Central banks often provide forward guidance on interest rate policy, signaling their intentions to markets. Investors closely monitor these communications for clues about future rate changes.

Economic Indicators: Key economic indicators, such as inflation rates, employment data, and GDP growth, will influence the pace and magnitude of future rate hikes. Stronger-than-expected indicators may lead central banks to take more aggressive actions.

Long-Term Considerations

Looking further ahead, several long-term factors will shape the trajectory of interest rates:

Demographic Trends: Aging populations in many developed countries influence economic growth and demand for credit. As the workforce shrinks, potential labor shortages may impact inflation and interest rate dynamics.

Technological Advancements: Advances in technology can improve productivity and efficiency, which may mitigate inflationary pressures. This could lead to a more stable interest rate environment over the long term.

Global Economic Ties: The interconnectedness of global economies means that interest rates in one country can influence rates in others. Central banks must consider international developments when making policy decisions.

Conclusion

The rise of interest rate hikes is a focal point in financial news, reflecting broader economic trends and challenges. As central banks navigate the delicate balance between managing inflation and supporting growth, their decisions have far-reaching implications for consumers, businesses, and financial markets.

Understanding the factors driving these interest rate hikes can help investors and consumers make informed decisions. While interest rate increases can pose challenges, they also present opportunities for those prepared to adapt to changing economic conditions.

As we move forward, the landscape of interest rates will continue to evolve, influenced by a multitude of factors. Staying informed and proactive in response to these changes will be essential for navigating the complexities of the financial markets and personal finance in the years to come.